Ready To enroll in

rocket credit management?

Here's How To Complete Your New Client Onboarding

Review the program options below

Click the SIGN UP NOW button

Complete your onboarding form

Access your SmartCredit credit report

Schedule your Blastoff Call

Review & sign the Client Service Agreement

Credit monitoring subscription w/ SmartCredit required ($25/month)

Rocket

Total Credit Management

Work with the Rocket team + nationwide network of consumer attorneys.

All our Award-Winning Programs

For One Low Price!

Affordable pricing with premium services included

Custom Credit Disputes: Tailored dispute techniques to address specific legal violations, reviewed by our Legal Team for accuracy and impact.

Legal Protection: Our attorneys are prepared to litigate credit violations under FCRA, FDCPA, UCC, METRO2, and other state and federal regulations—at no cost to you.

NeverDeniedAgain® Credit Card Approval Plan: Progressively build credit with our expert guidance toward high-limit rewards cards with cash back, points, and travel bonuses.

Maximize Card Benefits: Learn how to manage new accounts and unlock rewards like free flights, first-class upgrades, hotel stays, and exclusive lounge access.

RealtorReady® Home Buying Program: Get step-by-step guidance through the home-buying process, including loan options and credit preparation to start shopping for your dream home.

1-on-1 Coaching with the Rocket Team: Personalized support to help you reach your credit and financial goals, every step of the way.

Credit Monitoring subscription through SmartCredit ($25/month) required for all programs.

$125/month

Only $125 to sign up.

( Initial payment will be $125, due when our team has completed your initial onboarding, for work already completed. Additional months of service will also cost $125, beginning 30 days after the initial payment. You can cancel anytime.

Family & Friends Plan

Family and Friends Plan

Add someone to your plan

And they don't pay

the sign-up Fee!

$0 due at sign-up for anyone you add.

Work with the Rocket team + nationwide network of consumer attorneys

Same Program, Family Pricing: All the same amazing features as the Blastoff Plan, discounted for your family.

#CoupleGoals: Work on your goals as a team and stay motivated and accountable.

$125/month

$0 required at sign up for your family & Friends.

First monthly payment of $125 Due After 30 Days

$0 required at sign up for Your family & friends.

First monthly payment of

$125 Due After 30 Days

Smartcredit

credit Monitoring

The BEST Credit Monitoring On The Planet

**Required for all Rocket plans

Full Credit Report Access: View and monitor your credit reports from all three major bureaus in one place.

$1 Million Identity Theft Insurance: Comprehensive protection against identity fraud and unauthorized activity.

PrivacyMaster® Dark Web Monitoring: Scans and removes your personal information from the dark web, safeguarding your privacy.

MoneyManager Tool: Consolidate all your accounts, track spending, and stay on top of payments for better financial control.

Automatic Payment Alerts: Get reminders on the best dates to pay down balances and give your credit score an easy boost.

$24.99/month

$1 for free 7 day trial

Can I cancel my service at any time?

Absolutely! Credit is goal-driven. That means that our goal is to help you reach your goals, and you are able to cancel your service whenever you are satisfied with your credit score. There are no cancellation fees.

How does Credit Management work?

Think of your credit score like a seesaw, with your positive items on one side and any negative items on the other side. There is a complex math problem that produces your 3-digit "credit score", but basically that math problem is calculating the BALANCE between the positive and negative items on your credit report, ie: do your positive items weigh more or less than your negative items.

The ONLY way to improve your credit score is by changing that balance so that your positive items weigh more than your negative items. What is more, there are only TWO ways to change your "balance" and that is by removing the negative items that are weighing your score down, or by adding positive credit items to help prop your score up.

At Rocket, we are one of the few companies that work on your credit from BOTH sides of your score, by helping to remove any negative item on your credit report, while also helping our clients add positive credit through our Exclusive Line of Credit Building Products with Guaranteed Approval.

The combination of both adding positive information while removing negative information is the fastest way to help our clients reach their credit goals.

How long does the process take?

The national average for completion of a credit restoration program is 18-24 months. By contrast, Rocket Clients graduate our program in around 8 months or so (as of Sept 2022) on average.

There are a few reasons for this: Nearly all credit repair companies use a model where they only dispute or challenge 2 or 3 negative items at a time before moving on, which extends the program time AND the cost to you.

At Rocket, we challenge EVERY negative item EVERY SINGLE MONTH, which means our clients graduate the program faster, same money, and can get on with their life and enjoy their new credit as soon as possible.

Will Rocket help me get approved for new lines of credit, even if I have terrible credit now?

Absolutely! We have relationships with several lenders and credit card companies, and we have developed an Exclusive Line of Credit Building Products with guaranteed approval, no matter what your current credit score.

This is EXTREMELY important because how high your credit score can go is determined by the POSITIVE items on your credit report. Think of them like building blocks: the more of them you have, the higher your score and the stronger your credit profile will be.

ALSO, every piece of credit that reports each month can help minimize the impact of any negative items that may exist, so the more positive items the better.

This also sets you up for success AFTER you graduate the program, because lenders like to see thick credit reports with several lines of credit reporting positively every month. Likewise, lenders are skeptical of anyone that only has one or two low-limit lines of credit, because it does not show them if you can responsibly handle credit.

As our client's credit profile improves, we can help them navigate the maze of applying for even better lines if credit, like the high-limit, cash-back cards or reward-point cards by letting them know their approval odds and best options.

What type of negative items might be removed?

Virtually any item on your credit report carries the possibility of removal, including Bankruptcies, Charge-Offs, Collections, Medical Bills, Late Payments, Repossessions, Cell Phone and Utility Bills, Student Loans and Hard Inquiries.

Credit repair is about creating leverage against the alleged negative items on a credit report by compiling evidence that something (usually multiple things) about either WHAT is reporting (factual disputing) or HOW it was reported (METRO2 Compliance).

Each month, we send out a new round of attack letters, piling on to the evidence for why the credit bureaus or creditors should remove the challenged item, either because of a factual inaccuracy, a reporting violation or a violation of federal law, any of which can be grounds for removal.

What does 1-on-1 attention mean?

If you wanted to muddle through the process by yourself, we figure you would not have called us. After all, why stumble around in the dark when you have access to a seasoned guide with a flashlight?

Also, no client is the same, so there is no one-size-fits-all plan that works for everyone. Our solution to this is personalized, individual service.

Very quickly after each client signs up, our CEO Dustin (aka the TikTok Credit Geek) schedules a meeting with them to go over their credit profile personally and develop a plan specific to that client. Dustin will lay out what our strategy will be, but also gives each clients actionable steps they can take to maximize their success and ensure that they aren't leaving credit points on the table.

This will include little-known strategies for improving your credit virtually overnight, plans for opening new lines of credit (if needed), as well as what habits clients can develop to master the credit game for life.

Dustin will touch base with each client EVERY 45-60 days, which gives each strategy enough time to be implemented and show results so we can determine what the next steps should be to help our clients reach their goals. These meetings serve to keep everyone on track, motivated, and accountable for what they said they were going to do.

This is very important. We will be committed to helping our clients reach their goals, and we need our clients to have the same level of commitment and dedication to their credit repair process. We want clients that WANT TO WIN!

How will I see the progress?

Several ways. We send regular updates about what we are doing, including what steps we are taking as what our clients should expect.

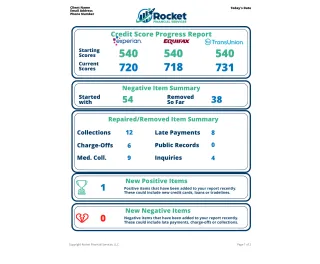

We also send each client a progress report each month showing the changes in credit score, how many negative items have been removed or updates, as well as a short list of tasks they can take to help improve their score.

Each client also receives access to their own Client Portal where they can see their current scores, dispute results and send messages back and forth to their account manager.

Trust us, there is a LOT of communication. You won't miss us for long before we are reaching out to you with another update.

Click the picture to see an example of the Monthly Progress Report.